Current Status of the Non-Inductive Resistor Industry

I. Introduction

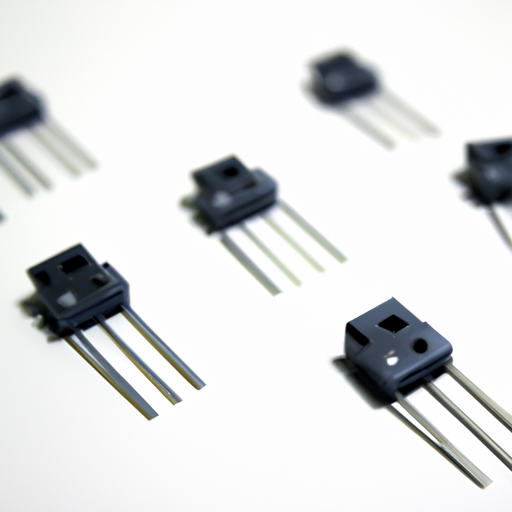

Non-inductive resistors are specialized components designed to minimize inductance, making them essential in applications where precision and stability are paramount. Unlike traditional resistors, which can introduce unwanted inductive effects, non-inductive resistors are engineered to provide a more accurate and reliable performance in various electronic circuits. Their significance spans across multiple industries, including power electronics, consumer electronics, automotive, and aerospace, where they play a crucial role in ensuring the efficiency and reliability of electronic systems. This report aims to provide an in-depth analysis of the current status of the non-inductive resistor industry, exploring market trends, technological advancements, applications, and future prospects.

II. Overview of the Non-Inductive Resistor Market

A. Market Size and Growth Trends

The non-inductive resistor market has witnessed significant growth over the past few years. Historical data indicates a steady increase in demand, driven by the expansion of the electronics sector and the rising need for high-performance components. As of 2023, the market valuation for non-inductive resistors is estimated to be around $1.2 billion, with projections suggesting a compound annual growth rate (CAGR) of approximately 6% over the next five years. This growth is fueled by advancements in technology and the increasing adoption of electric vehicles and renewable energy solutions.

B. Key Players in the Industry

The non-inductive resistor industry is characterized by a mix of established manufacturers and emerging companies. Major players include Vishay Intertechnology, Ohmite Manufacturing Company, and TE Connectivity, which dominate the market with their extensive product offerings and strong distribution networks. Emerging companies are also making their mark, focusing on innovative designs and niche applications. A market share analysis reveals that the top five manufacturers account for nearly 60% of the total market, highlighting the competitive landscape and the potential for new entrants.

III. Types of Non-Inductive Resistors

A. Wirewound Resistors

Wirewound resistors are one of the most common types of non-inductive resistors. They are constructed by winding a resistive wire around a non-conductive core, which minimizes inductance. These resistors are known for their high power ratings and excellent thermal stability, making them suitable for applications in power electronics and industrial equipment. However, they can be relatively bulky and may have limitations in terms of resistance values.

B. Film Resistors

Film resistors, including thin and thick film variants, are another category of non-inductive resistors. They are made by depositing a resistive film onto a substrate, allowing for precise resistance values and compact designs. Film resistors are widely used in consumer electronics, such as audio equipment and home appliances, due to their low noise and high accuracy. However, they may not handle high power levels as effectively as wirewound resistors.

C. Other Types

In addition to wirewound and film resistors, the non-inductive resistor category includes carbon composition resistors and specialty resistors designed for specific applications. Carbon composition resistors are known for their high energy absorption capabilities, while specialty resistors may be tailored for unique requirements in fields like telecommunications and medical devices.

IV. Applications of Non-Inductive Resistors

A. Industrial Applications

Non-inductive resistors find extensive use in industrial applications, particularly in power electronics and test equipment. In power electronics, they are crucial for managing voltage and current levels, ensuring the safe operation of devices such as inverters and converters. In test equipment, non-inductive resistors are employed to simulate loads and measure performance accurately.

B. Consumer Electronics

In the consumer electronics sector, non-inductive resistors are integral to audio equipment and home appliances. Their low noise characteristics enhance sound quality in audio devices, while their reliability ensures the longevity of home appliances. As the demand for high-fidelity audio and smart home technologies continues to rise, the need for non-inductive resistors in this sector is expected to grow.

C. Automotive and Aerospace

The automotive and aerospace industries are increasingly adopting non-inductive resistors, particularly in electric vehicles (EVs) and avionics systems. In EVs, these resistors are used in battery management systems and power distribution units, where precision and reliability are critical. In aerospace applications, non-inductive resistors contribute to the safety and performance of avionics systems, where any failure could have severe consequences.

V. Technological Advancements

A. Innovations in Manufacturing Processes

The non-inductive resistor industry is witnessing innovations in manufacturing processes that enhance product quality and reduce costs. Advanced techniques such as automated winding and precision film deposition are improving the consistency and performance of resistors. These innovations are enabling manufacturers to meet the growing demand for high-performance components while maintaining competitive pricing.

B. Development of New Materials

The development of new materials is also playing a significant role in the evolution of non-inductive resistors. Researchers are exploring alternative materials that offer improved thermal stability, lower noise levels, and higher power ratings. These advancements are expected to lead to the creation of next-generation resistors that can meet the demands of emerging technologies.

C. Integration with Smart Technologies

As the industry moves towards smart technologies, non-inductive resistors are being integrated into smart devices and systems. This integration allows for enhanced performance monitoring and control, enabling manufacturers to develop more efficient and reliable products. The trend towards smart technologies is expected to drive further innovation in the non-inductive resistor market.

VI. Challenges Facing the Industry

A. Supply Chain Disruptions

Despite the positive growth trends, the non-inductive resistor industry faces challenges, particularly related to supply chain disruptions. Global events, such as the COVID-19 pandemic, have highlighted vulnerabilities in supply chains, leading to delays and increased costs for manufacturers. Addressing these challenges will be crucial for maintaining market stability.

B. Competition from Inductive Resistors

The competition from inductive resistors poses another challenge for the non-inductive resistor industry. While non-inductive resistors offer distinct advantages in specific applications, inductive resistors may be more cost-effective for certain uses. Manufacturers must continue to innovate and demonstrate the value of non-inductive resistors to maintain their market position.

C. Regulatory and Compliance Issues

Regulatory and compliance issues also present challenges for the industry. Manufacturers must navigate complex regulations related to environmental standards and product safety, which can impact production processes and costs. Staying compliant while remaining competitive will require ongoing investment in quality assurance and regulatory expertise.

VII. Future Outlook

A. Market Opportunities

Looking ahead, the non-inductive resistor industry is poised for growth, driven by several market opportunities. The expansion of the renewable energy sector, particularly in solar and wind energy, presents significant potential for non-inductive resistors in power management applications. Additionally, the increasing demand for electric vehicles is expected to create new opportunities for manufacturers, as these vehicles require high-performance components for efficient operation.

B. Predictions for Market Evolution

Predictions for the market evolution suggest that the non-inductive resistor industry will continue to grow, with an increasing focus on innovation and sustainability. As manufacturers invest in research and development, we can expect to see the introduction of new products that meet the evolving needs of various industries.

C. Strategic Recommendations for Industry Players

To capitalize on these opportunities, industry players should consider strategic recommendations such as diversifying product offerings, investing in advanced manufacturing technologies, and strengthening supply chain resilience. Collaborating with research institutions and technology partners can also drive innovation and enhance competitiveness in the market.

VIII. Conclusion

In summary, the non-inductive resistor industry is experiencing a period of growth and transformation, driven by technological advancements and increasing demand across various applications. While challenges such as supply chain disruptions and competition from inductive resistors persist, the future outlook remains positive. By embracing innovation and addressing industry challenges, manufacturers can position themselves for success in this dynamic market.

IX. References

- Academic Journals

- Industry Reports

- Market Research Studies

This blog post provides a comprehensive overview of the current status of the non-inductive resistor industry, highlighting key trends, challenges, and future opportunities. As the industry continues to evolve, staying informed and adaptable will be essential for stakeholders looking to thrive in this competitive landscape.